From its Tryst With Death to a $1.5 Billion Valuation, How Did 'Segment' Turnaround to Unicorn Status?

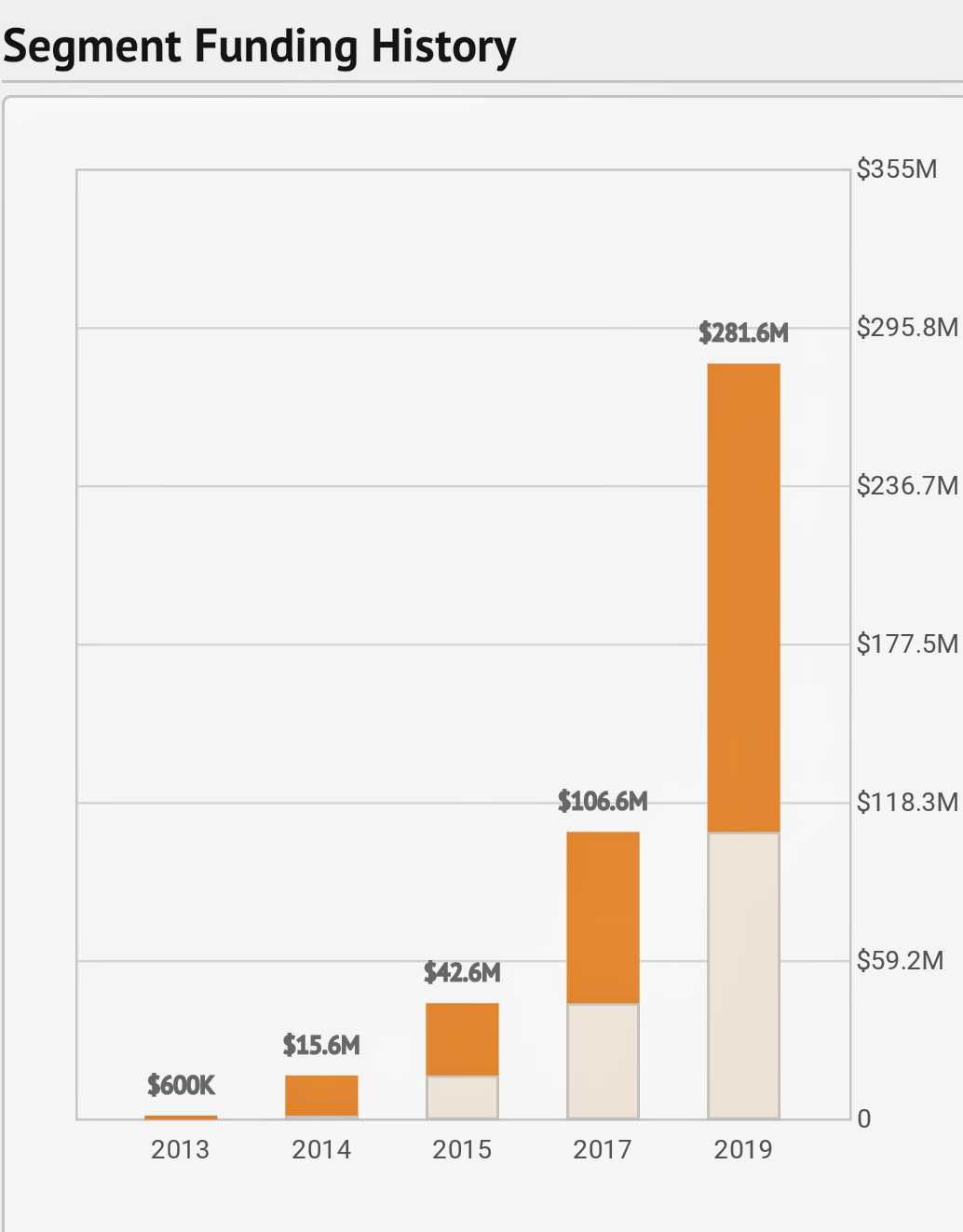

About a year ago, Segment (formerly known as Segment.io), the world’s leading Customer Data Platform (CDP), raised $175M through its latest round of funding. The Series D round brought its total funds raised to over $280M for a $1.5B valuation. At the turn of the year into 2020, Deloitte named Segment as one of North America’s fastest-growing technology companies.

Start of an Entrepreneurial Journey

In 2011, when their journey began, Segment founder and CEO Peter Reinhardt along with his two roommates (co-founders) had no idea their classroom analytics startup would be the disaster that it was.

Their idea emerged at MIT, where Reinhardt at that time was studying Aerospace Engineering and his roommates were students of Computer Science. They developed a classroom analytics tool that enabled students to press a button if they were confused during a lecture. The data would get compiled and a graph was shared with the professor. If more than 40% of the class was confused the professor would halt the class.

After a demonstration in spring, Reinhardt and the team raised $600,000 over the summer, and the product was brought to market in the fall 2011 semester as enough professors had agreed to its launch. The idea got Segment accepted into Y Combinator.

As per Reinhardt, "it proved to be the most distracting thing you could put in the classroom." Instead of using the tool in your laptop to signal confusion, take notes, or ask questions, by the end of the lecture 80% of the students were found skimming through Facebook or other social media.

Pivoting From the Initial Plan

With 8 investors in hand and $600,000 raised, four months in, Reinhardt offered all of them their money back. Two out of the eight investors took their money back, while the remaining six asked him to find something else.

At this stage, Reinhardt, with only his senior year project left at MIT, dropped out and continued his journey from a dud classroom tool to developing an analytics tool. Segment, now headquartered in San Francisco, pivoted to Customer Data Infrastructure. They became the single source of truth for a company's customer data.

Developing the analytics tool took about a year. With tons of competitors ( like Google Analytics) and a difficult market scenario, Segment failed completely to get traction. The automatic insights tool they developed would look at all the possible segments of data and pull out any that were statistically different. It failed because nothing different was found.

At this stage, one and a half years into their entrepreneurial journey, what remained was $100,000 in the bank and 6 months runway in which to come up with something new.

Initial Traction

After two back to back failures, it was now their last shot. Co-founder Ian Storm Taylor suggested there is a big business behind analytics.js, and he brainstormed the idea of the analytics.js open source library. The team, particularly Reinhardt, wasn't impressed. He said, "that's literally the worst idea I ever heard!"

Later that evening, Reinhardt headed home with constant skepticism running through his mind about Ian's brutal idea. His skepticism was about building a business around 500 lines of code that was already open source.

After much contemplation, Reinhardt realized they were lacking options. He decided to go with the plan. The next morning he arrived at work knowing exactly how to implement the idea that he wanted to be killed a day prior. His execution plan involved pitching the value of the analytics.js open source library through a beautiful landing page (with a customer signup form at the bottom) and putting it up on Hacker News.

It was December 12, 2012, with money depleting up to now, yet this hack had got them their initial traction of 3000 email sign-ups. The idea had exploded and this became Segment's first tryst with success after one and a half years.

In a recent interview with 'Y Combinator', Reinhardt had said, "it felt like losing control, people would previously tell us they want a feature, but would not use it, and now they would use a feature and tell us they wanted a second feature." To Reinhardt and his team, these were clear indications they had found a real product-market-fit.

Search for "Customer Pain"

By now, Reinhardt and his team had learned what they were doing wrong for almost two years. "We were focussing on how the world should work, instead of finding the pain and solving the need, " said Reinhardt in an interview with Jason Calacanis (This Week In Startups).

This was the difference that led them from failure to success. Instead of working around a mission, they now started building a vision around a real customer pain. It took them 2 years to figure this out.

Pricing Strategy

Reinhardt's MIT background meant everything should be free. Eventually, after their second pivot and initial traction with the analytics.js tool, they apologetically emailed customers for a $10 a month upgrade. As an eye-opener, a customer named Edwardo Alberto from Brazil wrote back saying "your price is too low!" Reinhardt then hired a sales advisor who purported to ask $120,000 per year from customers. Later, in dealing with a new customer, Reinhardt closed a deal at $18,000 per year, which is bizarrely large compared to the monthly $10 upgrade they were apologetically asking for.

Footprint of the Business Today

Segment has now raised four rounds of venture capital totaling almost $300 million, including a $175 million raised last year. The company is valued at an impressive $1.5 billion. They have about 600 employees, primarily in San Francisco and New York, with 25% of them having an engineering background and the rest in Sales and Marketing.

Besides North America, their other office locations are in EMEA and Asia Pacific. They have more than 20,000 customers, including IBM, TravelPerk, Levi’s, New Relic, GAP, and Time magazine. Among their notable investors are Accel, Meritech Capital Partners, Alphabet Inc's GV, Thrive Capital, and e.ventures.

Graph Source: www.owler.com

Competitive Landscape

Segment has the focus of helping companies manage data within their four walls. Traditionally, the entire interaction within a customer is managed with a CRM, but Segment's true product-market-fit was found on the basis that CRM is not enough. What differentiates Segment is the focus on more digital interactions. It strives to solve much broader problems than CRM. The customer infrastructure layer is different from the business application layer. For Segment, this proves to be a huge independent opportunity, because of which Segment continues to go long instead of selling off. Some of Segment's biggest competitors include companies like Platfora, Mixpanel, Snowflake, and Panoply. Segment leads all of them in the number of customers, total funding raised, valuation, number of employees, and revenues.

Before the first pivot, Peter Reinhardt was quick to offer a refund of investors' money. This ethical move led six out of eight investors to keep their faith in the company. Given its present-day valuation, those investors that pulled out must be regretting their decision. If it hadn't been for such values, Reinhardt and the team wouldn't have reached their third business plan after the first two had bombed.